Introduction

DocStation is a web-based, SOC-2 and HIPAA-compliant software platform connecting pharmacies and health plans to facilitate clinical and quality programs. DocStation identified member care gaps through raw clinical files provided by a health insurance company that focuses on providing Medicare Advantage plans to seniors. Member care gaps were presented to participating pharmacies through DocStation and integrations with pharmacy operating systems used throughout the medication fulfillment process. Pharmacies addressed and closed care gaps through a guided, intervention-specific clinical pathway while collecting clinical and demographic data critical to the health plan’s strategy and overall success (e.g. blood pressure readings).

Network

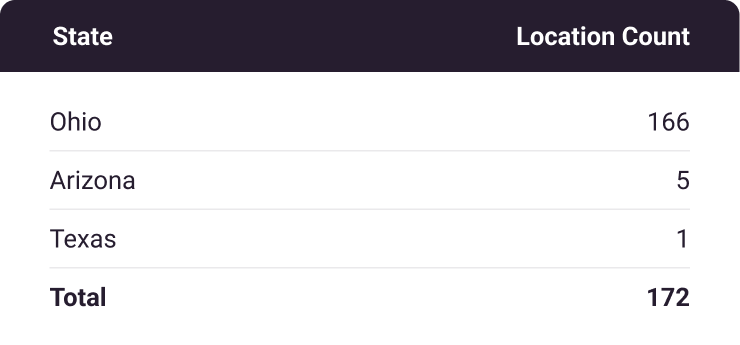

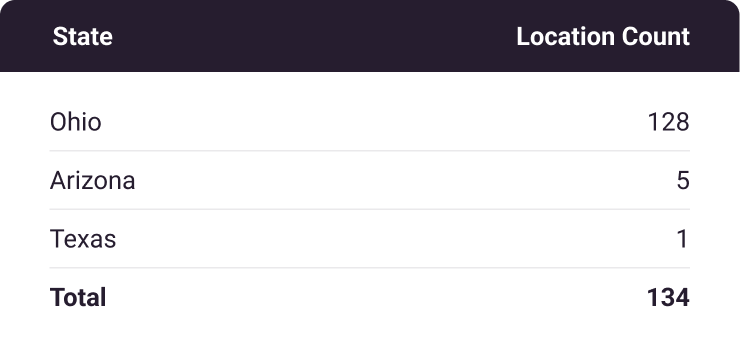

The DocStation pharmacy network and platform were first deployed in July 2021 in Arizona and Ohio, two newly launched payer markets at the time. Using payer-provided pharmacy and member files, DocStation identified and established downstream entity contracts with key pharmacies who service the payer members. Today, DocStation’s network consists of 172 brick-and-mortar pharmacies spanning four states and 134 zip codes across payer’s markets (Table 1, Table 2).

Unique Locations by State

Table 1

Unique Location Zip Codes by State

Table 2

Pharmacy Utilization

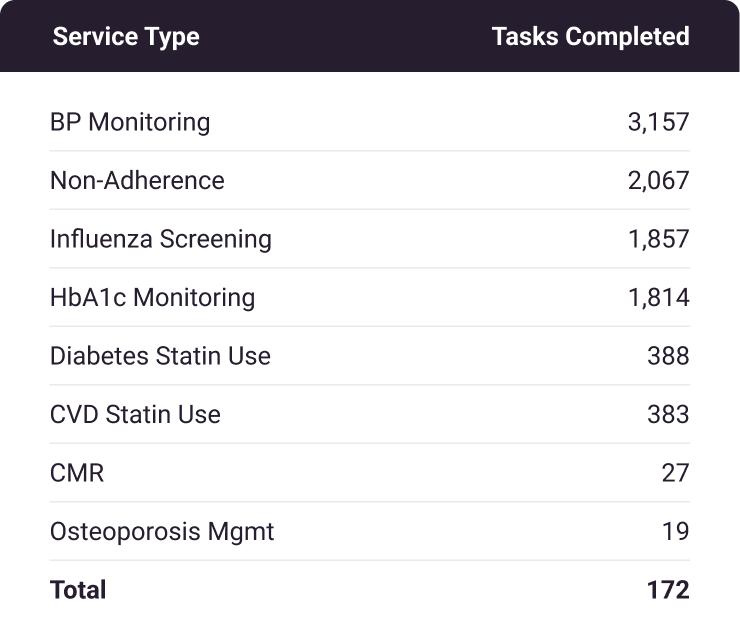

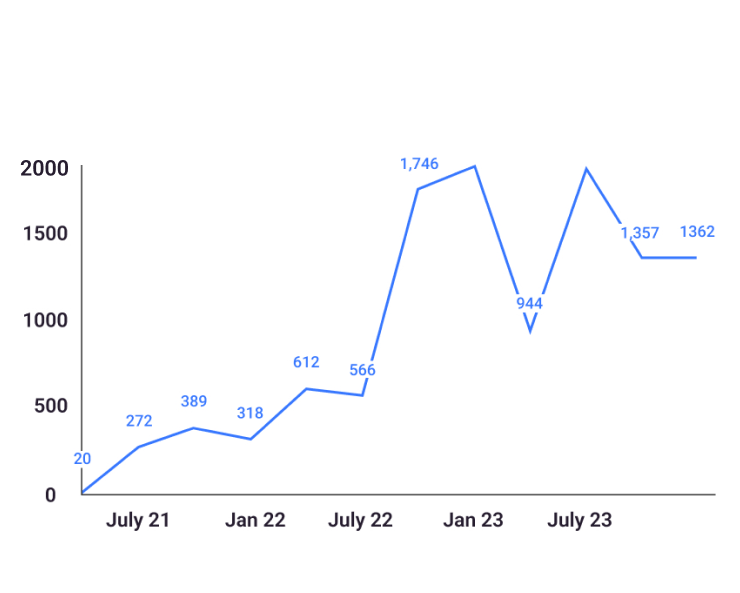

Since launch, pharmacies have completed a total of 9,712 encounters through the DocStation program, largely encompassing eight service types outlined in the table below (Table 3). As one might expect, the majority of encounters performed are in core competency areas relative to pharmacy practice, such as medication adherence and immunization services. As the payer’s membership has grown, DocStation has expanded its pharmacy network, which has driven a substantial increase in quarterly member engagements over time (Figure 1).

The median time from gap identification to encounter completion was 18 days. Of attempted member engagements, 72.4% resulted in a successful encounter. This presents an opportunity when compared to the wait times members would expect in a primary care setting. Additionally, DocStation provides an opportunity to drive year-end quality measure sprints for thousands of members across pharmacy network-covered markets.

Overall, it is clear that pharmacies participating in the program are highly engaged when financial incentives are available for non-dispensing activities.

Encounters by Service Type

Table 3

Pharmacy Encounters by Quarter

Figure 1

Network Performance

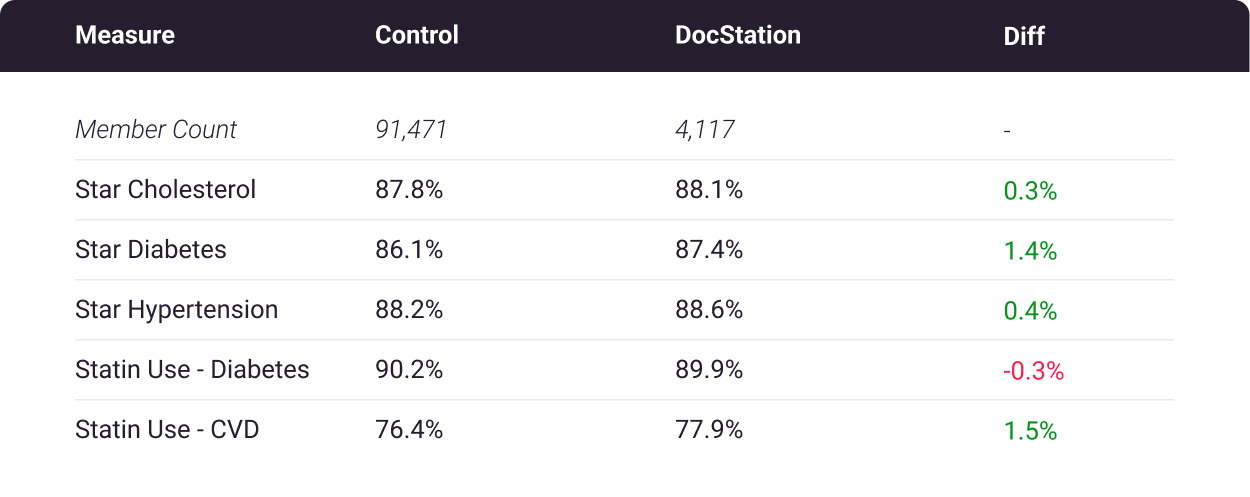

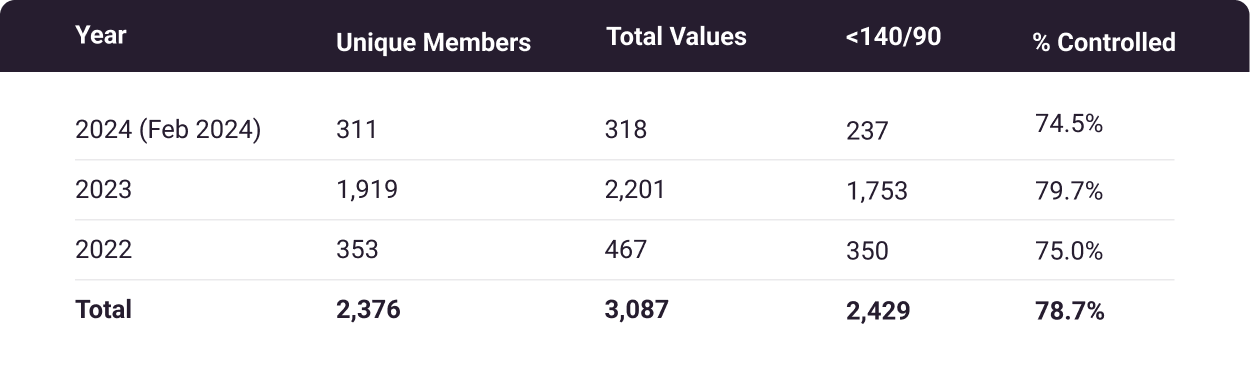

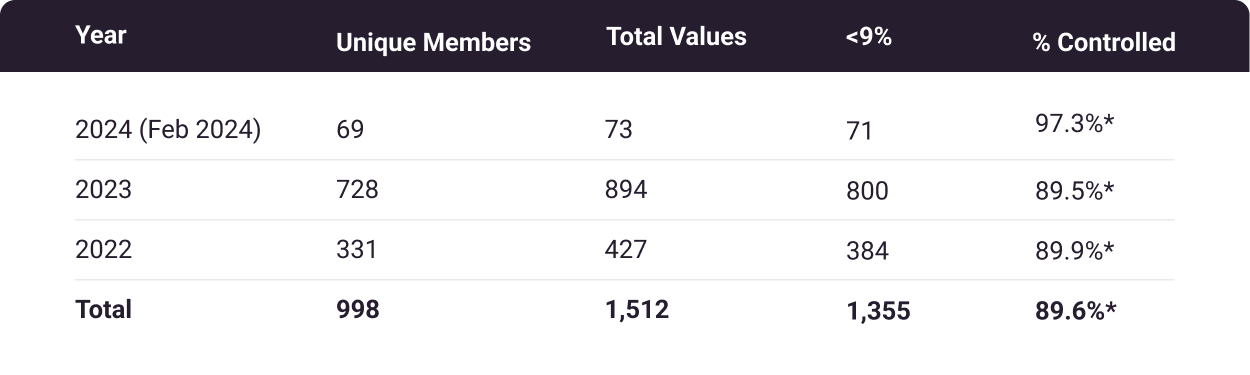

Since DocStaton program conception, the payer has maintained repeated 5 star domain and overall ratings, even while launching into new marketplaces. As an adjunct to the payer’s Star Measure strategy, in 2023 DocStation pharmacies outperformed their control counterparts on all but one quality measure. Although pharmacist-collected blood pressure and hemoglobin A1c values are not currently HEDIS-certified, pharmacies have been successful in capturing early-year values, which would otherwise be a challenging and expensive effort through alternative methods such as chart auditing. Impressively, 78.7% of blood pressure values and 89.6% of HbA1c values documented by pharmacies through the program are within control parameters outlined by CMS, a 4 and 5 Star average respectively (Table 4, Table 5).

We believe continued collaboration with this payer on network operational improvement, care coordination, and DocStation tooling enhancement will demonstrate continued improvement in member access and overall performance.

2023 Star Measure Performance:

DocStaton Attributed Members vs. Control

Table 4

Pharmacy-recorded Blood Pressure Readings

Table 5

Pharmacy-recorded Hemoglobin A1c Values

Table 6

*5-stars according to 2024 Medicare Part C cut point

Return on Investment

Since program launch in 2021, DocStation pharmacies have completed 9,712 encounters with 3,839 unique payer members for a cost of $56.62 per encounter. The PMPM cost of successfully engaged members through the DocStation program is $3.77; this would account for roughly 1.9% of the PMPM MAPD member allotment from CMS, according to 2023 MedPAC reports.

PMPM Costs: $549,921.99 total program costs / 3,839 unique members / 38 program months = $3.77

Per Encounter: $549,921.99 total program costs / 9,712 completed encounters = $56.62 per encounter

As displayed in Table 4 above, network pharmacies outperformed the control group on all but one quality measure. Without better characterization of baseline member utilization and risk factors, it would be challenging to definitively assign financial value to the improved quality measures in the limited DocStation cohort. What may be more compelling is the success in capturing early year blood pressure and hemoglobin A1c values amidst a multi-modal quality measure strategy in conjunction with care team members both internal and external to the payer.

Since 2021, 172 pharmacies have been identified and contracted as downstream entities by DocStation, which otherwise would have been labor costs shouldered by the health insurance company, through another vendor, expansion of internal clinical teams, or incorporated into a direct contracting strategy by existing networking teams.

Lastly, we believe there is inherent and untapped value in the network infrastructure that we’ve built in collaboration with the payer. The DocStation pharmacy network is highly engaged and can be quickly mobilized to address member gaps in care and other untapped opportunities, for example curbing increasing pharmacy spend.

Future Opportunities

Given the conclusions that can be drawn from the data since program launch, we feel the largest untapped opportunities to further drive value through the DocStation program are:

- Pharmacy Spend | Traditional efforts to curb pharmacy spend have been largely driven by PBM strategies related to formulary tier structure, step therapy, prior authorizations, etc. We feel there are opportunities for supplemental, pharmacy network-driven behavior interventions targeted at high cost and high utilization members.

- HEDIS Certification of BP & HbA1c Values | As displayed in Tables 5 and 6 above, pharmacies were highly successful in capturing blood pressure and hemoglobin A1c values, a high percentage of which demonstrate disease state control. Currently, these are not HEDIS-certified, meaning they do not directly contribute to their corresponding Star Measures. We feel there would be benefit in collaborating with internal HEDIS resources to certify these values would result in immediate value for the insurance company.

- Enhance Care Coordination | DocStation’s platform features in-application HIPAA-compliant messaging which is available to all of our health plan partners for targeted health plan-pharmacy communication. We feel incorporating this functionality would support many ad-hoc needs, for example confirmation of medication fill dates for any number of members.