Case Study

Clinical Services

DocStation Clinical Pharmacy Program

Medicare Advantage Health Plan

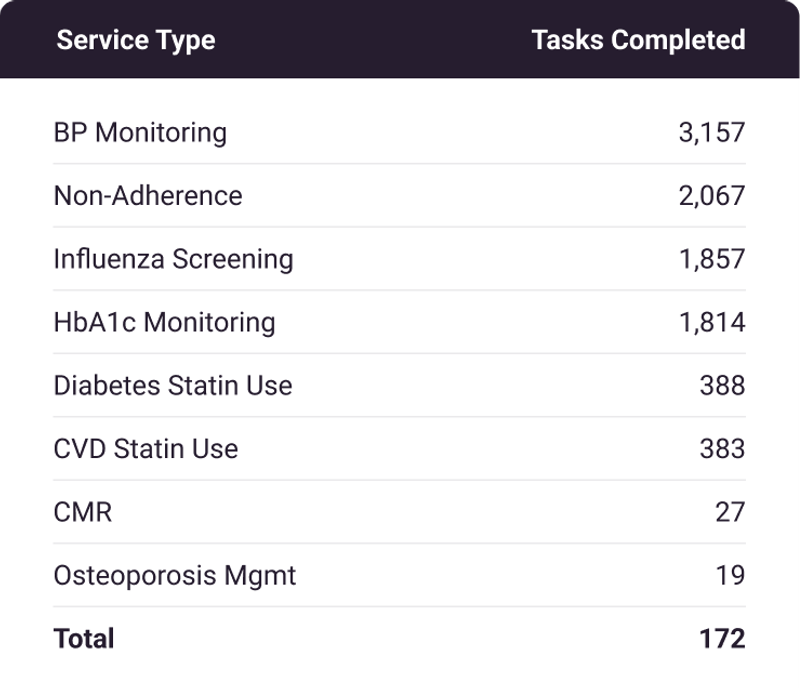

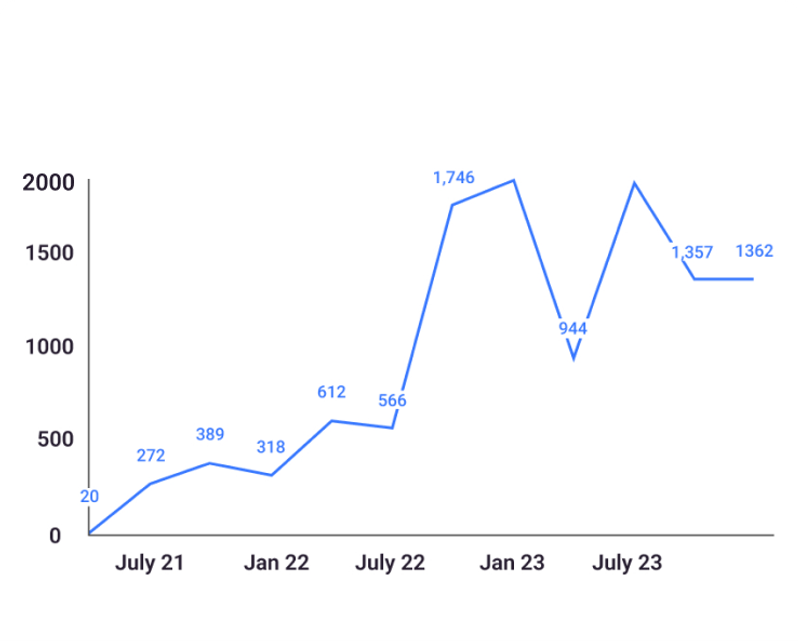

How DocStation's clinical pharmacy program connected 172 pharmacies across 4 states to serve nearly 10,000 Medicare patients with a 72.4% success rate while maintaining 5-star quality ratings.

9,712

Encounters

Total encounters completed since launch

72.4%

Success Rate

Of attempted member engagements

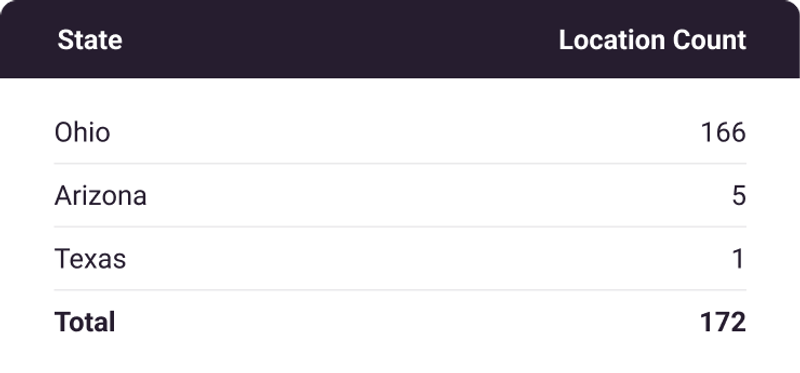

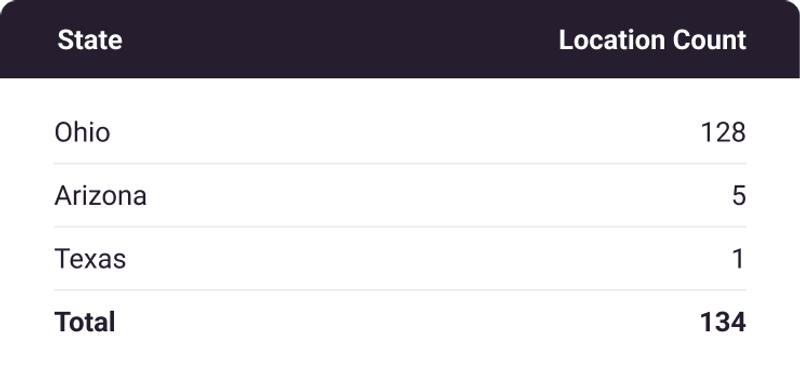

172

Network Size

Pharmacies across 4 states

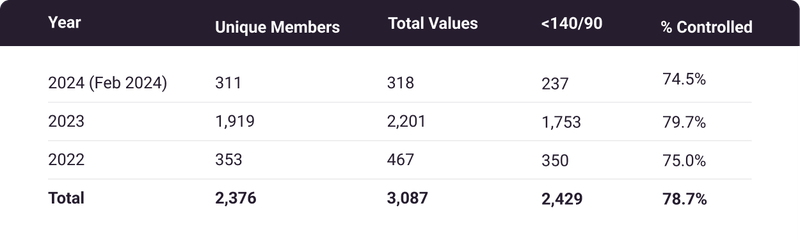

78.7%

BP Control

Blood pressure values within CMS parameters (4-star)

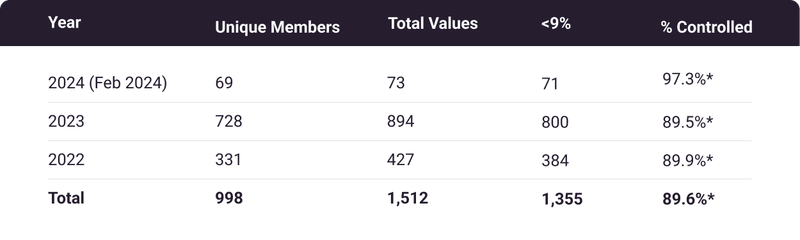

89.6%

HbA1c Control

HbA1c values within CMS parameters (5-star)

$56.62

Cost/Encounter

Program cost efficiency

More Success Stories

Related Case Studies

Clinical Services

A Tech-Enabled Value-Based Program to Reduce Total Cost of Care

Midwest Part D Sponsor

30,000Interventions

Read Case Study

Independent Pharmacy

Pharmacy Earns $70,000 in First Year with DocStation

California Independent Pharmacy

$70K+First Year Revenue

Read Case Study

Independent Pharmacy

Texas Pharmacy Nets $19,000 in First Month using DocStation Billing Automation

Austin, Texas Pharmacy

$19KFirst Month Revenue

Read Case Study